Digital Patterning ROI For Non Financial People - Part 1 of 3

Digital Patterning ROI For Non Financial People Part 1 of 3. How Much ROI Is Enough?

In this 3 part series on ROI, we look at 3 examples of how companies framed the ROI Case and we present it in a way to make it easy for you to do it yourself.

As the adoption of Digital Patterning continues to grow, ROI questions also grow.

Well managed companies want to know the ROI of existing and new processes.

It does not have to be difficult. We are presenting quick and useful ROI examples that take no more than 10 minutes.

What’s the problem anyway.

ROI is multi-faceted. Looking at digital patterning ROI from several approaches can be helpful. For example:

How much ROI is enough?

How to contrast cost savings benefits vs. Increase in productivity benefits

How to evaluate the prospect of expanded business opportunities.

Use the examples in the series for yourself for free. We hope they help.

Part 1: How Much ROI Is Enough?

Perspective 1: How much return to get from a dollar invested?

One way to look at this is to ask, if your company were to invest 1 dollar what is the expected rate return. If, for example, you received $1.15 for every dollar invested that would be a 15% rate of return. That would mean you would expect if you bought a new machine for $10,000, that it would deliver a 15% return or $1,500 in additional value over and above the cost.

Perspective 2: What is your cost of borrowing?

Another way to look at ROI is that it should be some amount higher than the cost to borrow money. Let’s say your company can borrow money at an interest rate of 5%, and you then invest that money in a new process. Your return has to be greater than 5% or you lose money. You would need a 20% rate of return in order to make a net return of 15% after borrowing costs.

Perspective 3: What is the risk I am taking? What is the success factor?

The general rule of the higher the risk taken, the higher the potential reward is certainly valid. If for example, you wanted an investment return of 15%. But the investment had some risk, say there was a 80% chance of success by the deadline date, and a 20% of not meeting the goal by the deadline. You would need to account for the “success factor” into your ROI minimums.

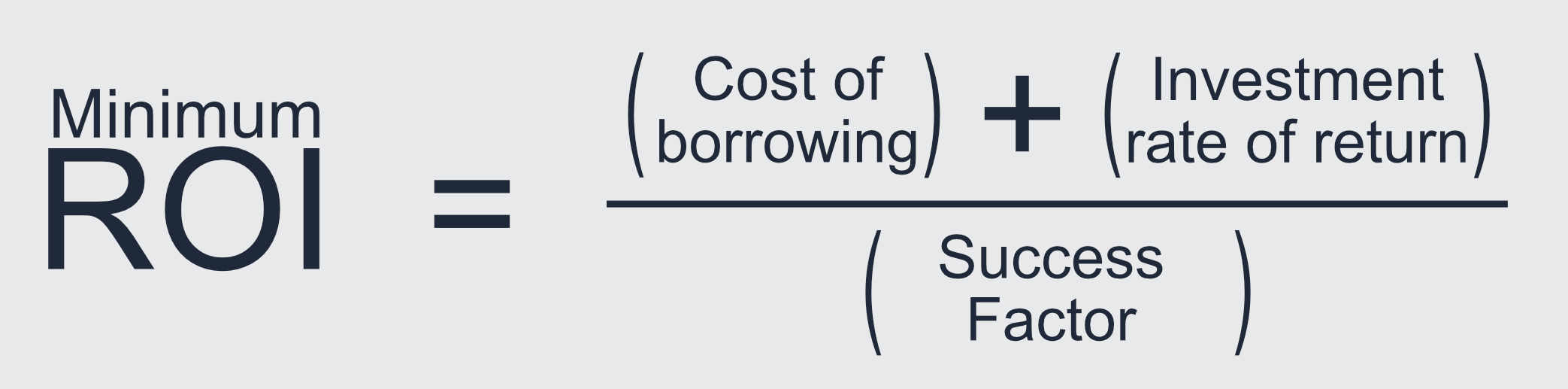

Here is a simple ROI formula that takes all these variables into consideration:

Where

The Cost of borrowing is the interest rate if your company took out a loan

The Investment rate of return is your minimum desired return from a "dollar invested."

The success factor is the chances of getting your full rate of return by the deadline date.

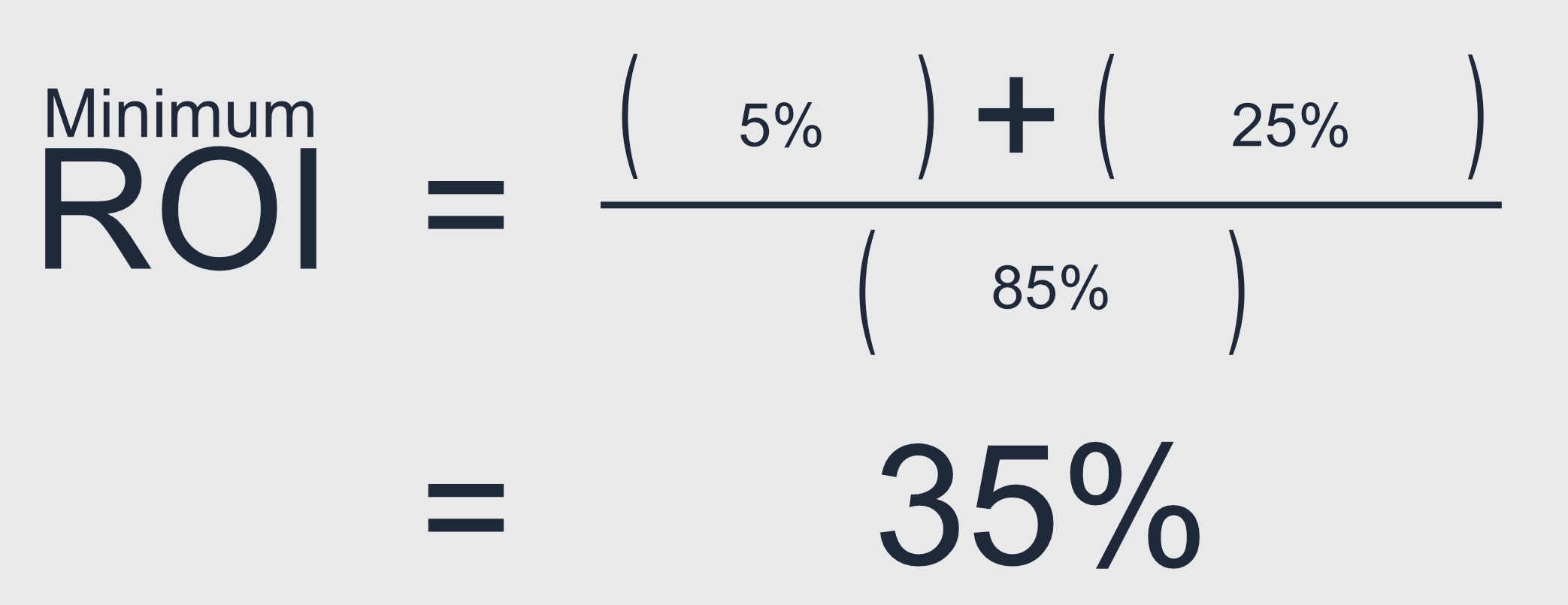

For example, if:

Your cost of borrowing is 5%

Your desired investment rate of return is 25%, and

Your success factor is 85% . That means you project a 85% probability that you can meet your improvement goal by your deadline date.

In this example, for every dollar invested you would project to get a $1.35 back in return. Off course the answer to "how much ROI is enough?" is up to you. However, with this way of looking at ROI you can run different scenarios in a matter of minutes and get aligned from the shop floor to the CEO.

In our experience in talking to companies in various industries, the actual ROI from shifting from legacy hand patterning to digital patterning can be significantly higher.

In part 2, we will look at how to contrast cost savings benefits vs. increase in productivity benefits of switching to digital patterning.

If you found this useful, please share and post on your social networks.